By Duncan Hsia of Infinite Financial

Part of a good mortgage broker’s job is getting a customer the lowest interest rate they can get. The other day, we went to the housewarming/baby shower for a customer, and he told me he was thankful he was able to get a rate in the 3’s, now that rates have moved much higher. I knew that he just closed within the past year, so I had to double check when I got home.

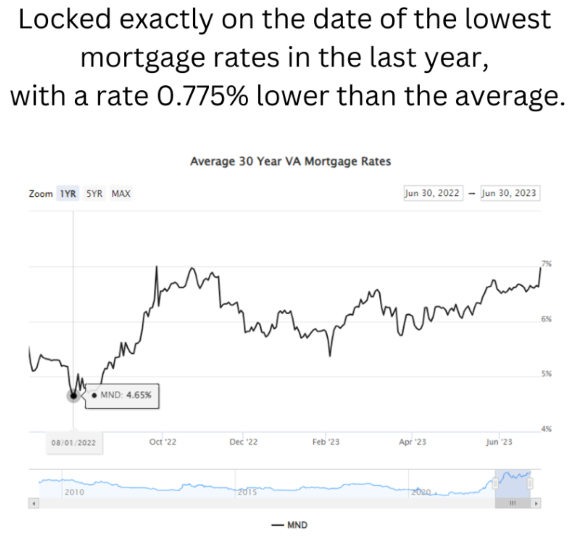

As you can see from this Facebook Post , I confirmed that he did get a rate in the 3’s by waiting 34 days to lock, and then locking on the exact day with the lowest mortgage rates in the past year, with a rate well below what other lenders could do at the time!

It definitely can make a huge difference who a customer uses for their mortgage. Not only do we close a lot of loans other lenders can’t do, but we also get the best terms for our customers. It’s important that loan officers have a good understanding of the markets, so they can effectively advise their customers.

Inflation in 3’s as Predicted

This morning, the PCE inflation report showed inflation in the 3’s for the first time in 2 years:

Per my latest video analyzing inflation and money supply with the help of ChatGPT’s Code Interpreter, I expect the June CPI report, out on July 12, to show inflation in the lower 3’s (with a chance of being in the upper 2’s, where the annualized inflation rate has been the last 11 months), not too far from the Fed’s 2% target. After that, the Fed will have much less reason to raise the overnight lending rate again, even though they’ve been telling everyone they plan to hike 2 more times, managing consumer inflation expectations.

In the video I posted right after the December CPI report showed CPI at 6.5%, after some analysis of the half-year CPI % changes, I said, “We may even see inflation in the 3’s by midyear, blowing away everyone’s expectations.” Consider a lot of minds to be blown…

Look for the June CPI report to confirm inflation in the 3’s, and much less fearmongering about high inflation among talking heads.

Higher AMI for Special Mortgage Programs

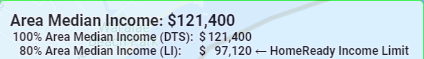

We just closed a loan taking advantage of the new, higher AMI level to get the added points for credit score and lower down payment waived, saving them thousands of dollars, and allowing us to close on a purchase at a 60% higher price than their previous lender pre-approved them for. Make sure the loan officers you work with understand how to take advantage of the special programs for limited income buyers to save a lot of money and qualify for more.

The new AMI level for Honolulu county is $121,400, with $97,120 the limit for HomeReady and Home Possible mortgages. These much higher limits mean a lot more buyers can qualify to save a lot of money and have a lot more buying power with the various special programs available – if their loan officer knows how to take advantage of them.

June Feature Article in Real Producers

This month’s issue of Real Producers magazine has a feature article on Infinite Financial and me, which you can see in flipbook format here, along with our new ad: Real_Producers_Article_with_ad . We’re honored to have been the first lender in Hawaii signed up by Real Producers, and to get our second feature article. Thanks to Bryn Kaufman, Mark Young, and Caron B Davis for providing nice review comments. You should see the magazine in your real estate office.

Professional Collaboration Conference – Super Saturday, July 15

For those interested in collaborating with some awesome professionals to offer additional services to your clients and create an extra stream of revenue, see the below flier and scan the QR code to register for the conference on Saturday, July 15 at 11am at the Ala Moana Hotel Plumeria Room. I hope to see you there!