Many times buyers have to cancel during the escrow process. The most likely reason for canceling is they are not satisfied with the inspection. Another reason could be they do not like something they found out on the disclosure statement. The 3rd big reason for canceling is they can’t get the loan.

If they have not breached the contract, then the buyer is should get their money back. For example, if they cancel using one of the reasons above, within the time frames allowed in the contract, then they should get all of their money back.

However, if they miss a deadline they no longer have the right to cancel using that contingency. For example, if the inspection is over, they have accepted it by default and they can no longer say they did not like the inspection and want to cancel.

This sounds easy enough, but it can be tricky in certain situations. For example, say there are 3 days left on the inspection, and the buyer requests some repairs. Now the buyer is waiting for the seller to get back to them. If the seller does not respond within 3 days, then the buyer has lost their ability to cancel because the inspection period is over. To prevent this the agent needs to keep track of the deadline and if it is approaching they need to try to extend the inspection period. If the seller does not respond to the extension request the buyer can decide to cancel or continue, but if they continue past those 3 days with no extension then they have lost their right to cancel because of the inspection period.

In some cases, there are still other ways the buyer can cancel even if their inspection period expired without a resolution. For example, perhaps they did not yet get the disclosure, or they have 10 days after receipt of disclosure to decide to continue or cancel. This gives them another out, so even if the inspection period expires, they could use the disclosure contingency to cancel. However, if the seller gets the disclosure to them day 1, then normally their disclosure contingency will be over before the inspection ends.

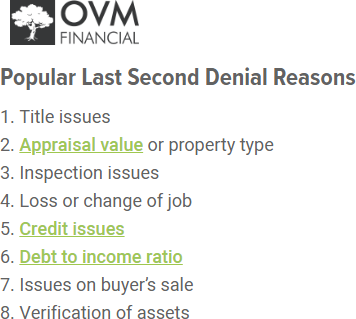

The finance contingency sounds simple enough in terms of a reason to cancel. If you can’t get the loan a buyer feels they have the right to cancel. However, there are deadlines in the finance contingency, and if you miss a deadline, just like the home inspection contingency, you lose your finance contingency. This is very tricky because the buyer’s agent might claim the buyer must cancel because of financing, but the seller’s agent might claim they lost that right because they did not deliver the conditional approval on time. So buyer’s agents have to watch this one closely to make sure the buyer stays within the timelines in the contract so they do not lose their ability to cancel if they can’t get the loan.

In our Standard Addendum, we added a paragraph to help with the finance contingency cancellation. It states if you can’t get the loan, you can cancel and get your money back. There are no time constraints in this paragraph, so it runs throughout the escrow and if it is part of the contract the buyer can cancel at any time if they can’t get the loan.

One other very important point to understand about escrow giving the buyer’s money back. Escrow is a neutral 3rd party. They will not make any decisions on the contract and who is right and who is wrong. So they only refund the buyer’s deposits if the seller also signs off on it.

This can be a problem at times. For example, say the buyer can’t get the loan and the buyer’s agent says everything was done on time so the deposits should be refunded. However, the seller’s agent disputes this and says the buyer lost their ability to cancel so the seller will not sign to give the buyer’s money back.

As escrow will not decide who is right and who is wrong they will hold onto the deposits until an agreement is reached. Many times this type of thing goes to mediation to help resolve it, and many times the deposits end up being split in some way between the seller and buyer to get them released.