Approximately 23% of homes in the MLS have an assumable mortgage, but less than 1% of the homes for sale are marked that way.

This means most sellers do not realize their loan is assumable.

VA, FHA, and USDA loans are assumable by anyone, not just the military.

22% of all sales this year were VA loans, and 1% of sales were FHA or USDA loans.

So approximately 23% of all sales this year and most likely in previous years have an assumable mortgage.

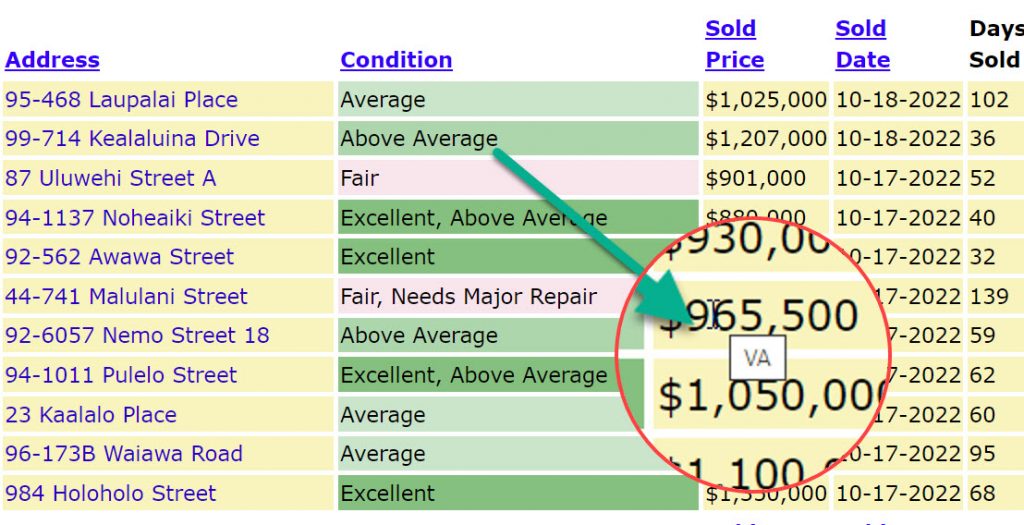

On OahuRE.com, you can see the type of financing used when a home was sold by either mousing over the sold price in the comparison view as shown in the image or viewing the sold price on the property detail page using a mobile phone or desktop.

If you see VA, FHA, or USDA, you then know the loan can be assumed and can discuss that option with the seller, who probably was not aware of it.

As many of those assumable loans would be in the 2% to 4% interest rate range, it is a very attractive option right now to assume that loan.