Escrow is most likely to fall out during the inspection period, but that happens early on in the escrow, normally within the first 2 weeks. After the inspection is approved and you are getting close to closing the most common reason escrow is cancelled is using the financing contingency.

Simply put, if the buyer can’t get their loan there is no way they can close. As long as they have not breached the contract prior, they can cancel and get all their deposits back.

This type of cancellation is the most frustrating for the seller, because the seller might have already moved out, rented or purchased another place, or maybe has a place in escrow and is counting on the funds from the home they are selling.

As bad as it is, there is really nothing that can be done when the lender says they can’t fund. You could look for another lender, but most likely the same reason the current lender can’t fund will come up and be an issue with another lender too.

One would wonder how the buyer got pre-approved only to find out they now can’t get the loan. Various factors can contribute to this, such as job loss, change of jobs, surprise on the tax returns, surprise liabilities, low appraisal, etc.

So what can a seller do to prevent falling out of escrow at the last minute from the finance contingency?

Typically the more money a buyer is putting down the less likely they are to fall out. Also you want to make sure you have a pre-approval, hopefully from a local lender, and you want to make sure they meet all the finance contingencies on time.

The biggest contingency is the conditional loan commitment letter. If this is late it could be a sign that the lender is having trouble committing to the loan and the reason it is late should be looked at closely.

We use 12 days before closing for the buyer to get the conditional loan commitment letter.

Getting a conditional loan commitment letter on time is one thing that is out of the buyer’s hands and relies on the lender.

Keep in mind if the lender is going to be late an extension must be requested, otherwise the buyer has breached the contract and the seller may elect to terminate the Purchase Contract.

If the buyer misses any of their loan deadlines the seller can cancel. However, normally it makes more sense for the seller to inquire as to why the deadline was missed and provide the buyer extra days if needed to prevent having to start again with a new buyer.

Low Appraisals – If the appraisal is low the first thing to do is to get a copy of it to look at the comparables used. Getting an appraisal changed is very difficult. If you have a strong issue with one of the chosen comps you can bring it up with the buyer’s agent and the buyer’s lender. Appraisers will have very good arguments on why they did what they did. Their job depends on doing it right, so they will be prepared to back up the appraisal. Having a bad appraisal is like saying they do not know how to do their job. That is why it is so difficult to get one changed.

If the appraisal is not changed the buyer will most likely request to pay the appraised price. Sellers can either accept this request, negotiate, perhaps to something mid-way between the appraised price and the Purchase Contract price, or stick with the price on the Purchase Contract.

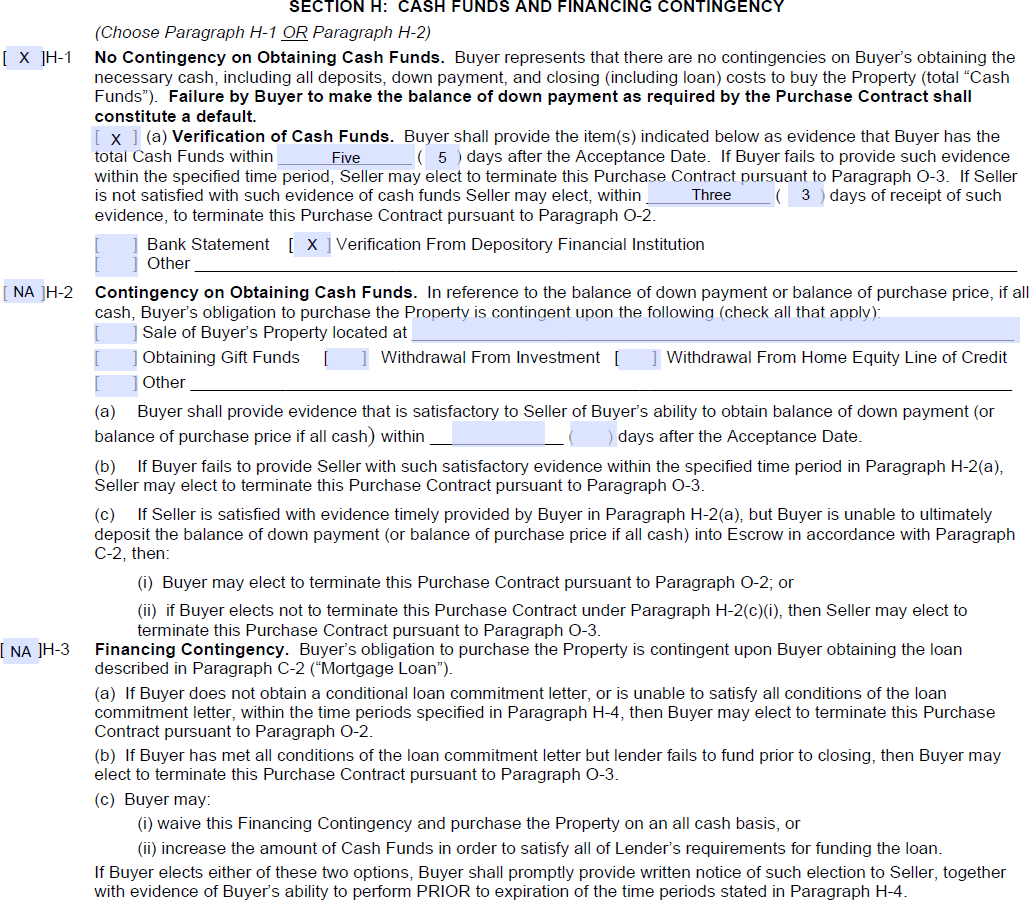

If the buyer can’t get the loan at the Purchase Contract price because of the low appraisal, then they would have the right to cancel. If they can still get the loan even though the appraisal is low, then they do not have the right to cancel using H-3.

Additional Search Terms – Finance Contingency, H1, H2, H3, H-1, H-2, H-3