The “As Is” Conditional Addendum sounds intimidating, but if you look at it closer, it does not mean much.

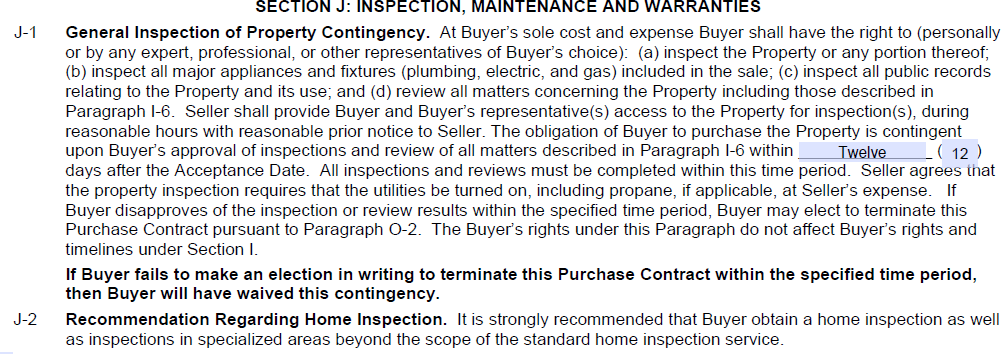

It does not change any of your rights during the inspection. You can still cancel, ask for credit, or ask for repairs.

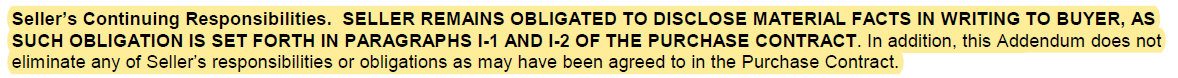

It does not change the seller’s responsibility to disclose everything on their disclosure statement.

It specifically says that the Purchase Contract overrides the “As Is” Conditional Addendum, so if you call for something to be repaired in the contract, this overrides the “As Is” Conditional Addendum.

It does not even help the seller after closing because it specifically says they are still liable for claims where they did not disclose a material fact. So the buyer can still sue after closing. As almost all lawsuits are because of an undisclosed material fact, the As Is specifically says the seller is still liable in these situations.

So, what does it do for the seller then? It simply sends a message that they prefer not to do repairs. Buyers can still ask for repairs, but sellers are saying up front that they prefer not to do any.