Details can be viewed at https://www.oahure.com/Statistics/MSR_2023-05MAY.pdf.

Details can be viewed at https://www.oahure.com/Statistics/MSR_2023-05MAY.pdf.

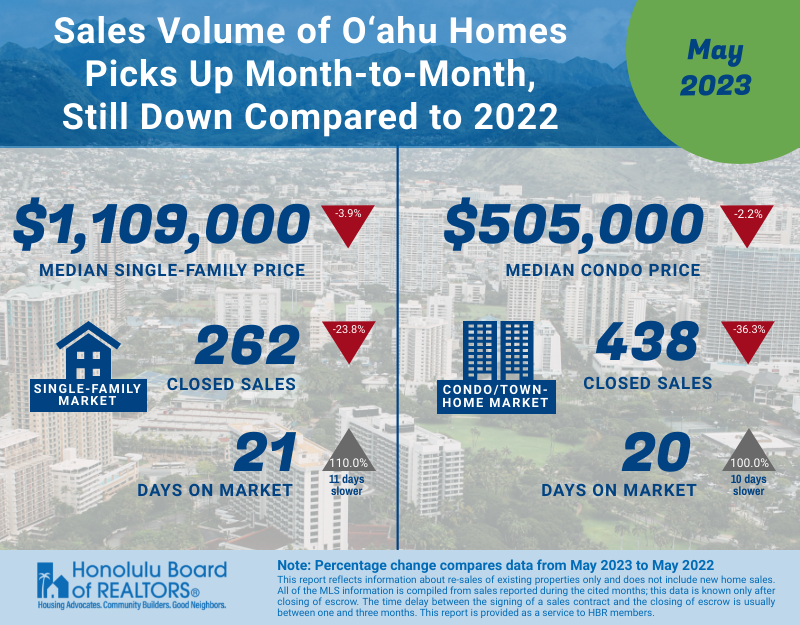

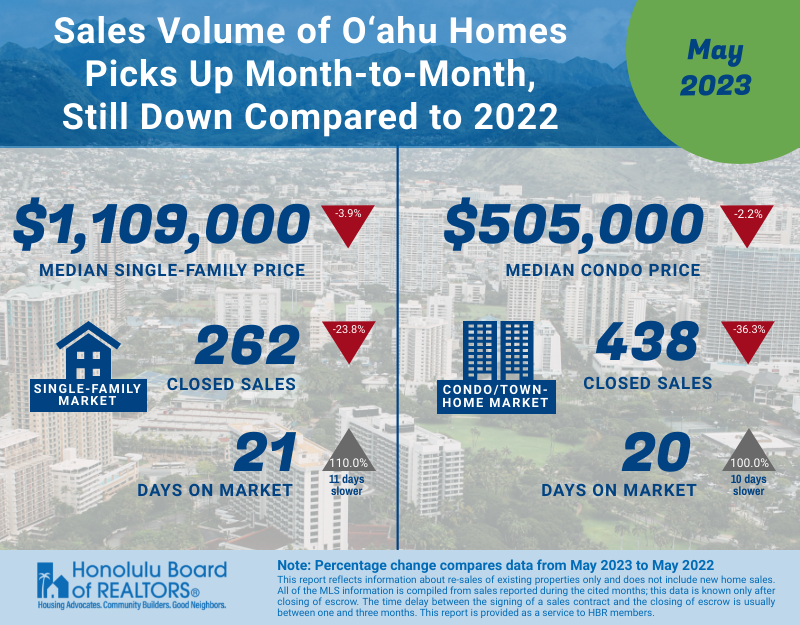

“We continue to see the market settle following the spike in interest rates and rising inflation,” said Fran Villarmia-Kahawai, president of the Honolulu Board of REALTORS®. “Compared to the frenetic real estate market we saw the last two years, sales momentum is sluggish, but median prices are holding steady due to low inventory.”

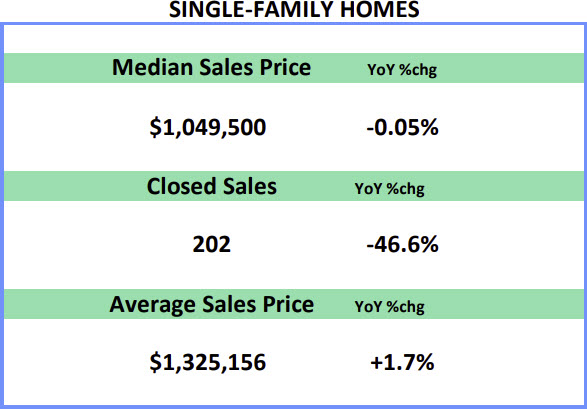

The Days on Market for Single Family is up 300%, wow.

It is definitely a slower market for sellers, and they are dropping their prices to sell.

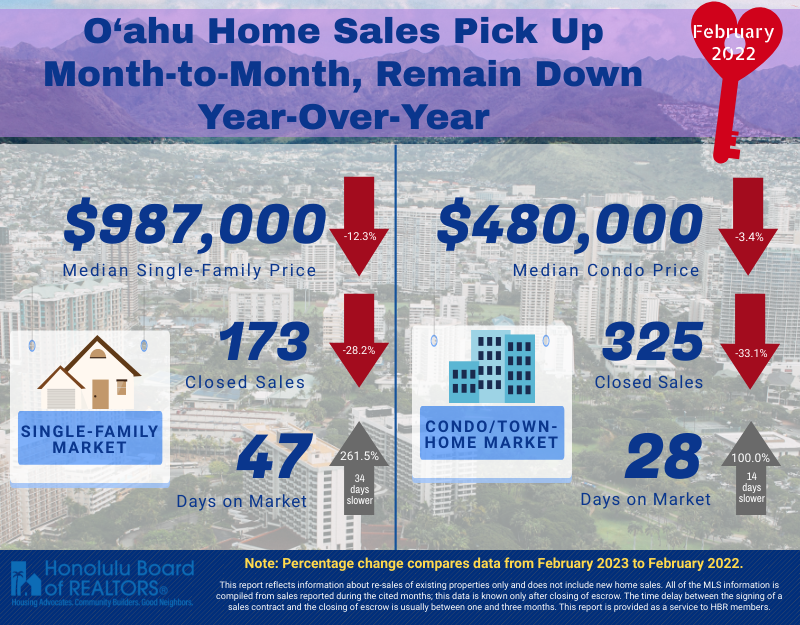

Day on Market Single Family up 261%. Last year it was 13 days. Now 47 days.

It is interesting that the Fed says the percentage of median income needed to buy a home is now the same as it was in 2006 before the housing crash, so homes are in no way inexpensive right now and prices will drop to a more normal level.

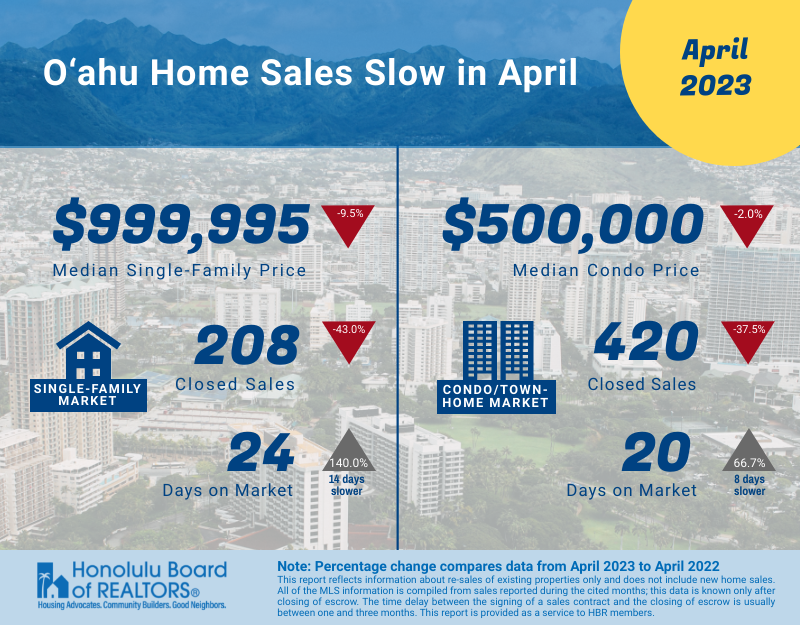

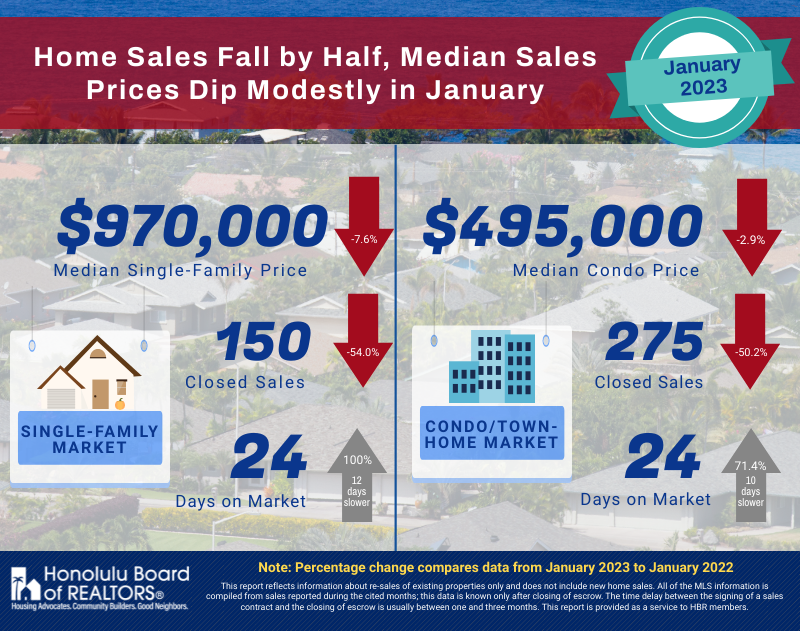

Prices are starting to drop. Some places are a lot more than the median 7.6%.

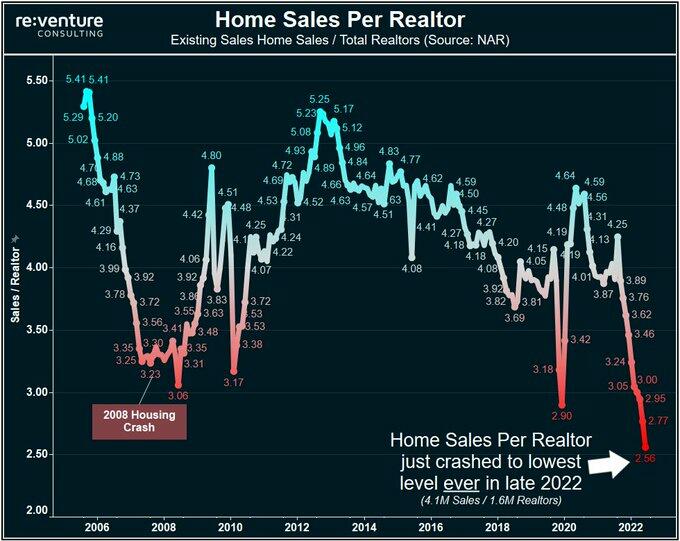

The National Association of Realtors said sales have crashed to the lowest level ever per Realtor.

It looks like close to 1/2 million Realtors will be looking for a new line of work in 2023.

I am noticing the slowdown already too much more than the 2008 housing crash.

As pending home sales have dropped lower than the 2008 housing crash, it is an excellent time to revisit what happened in 2008, as it seems we are going there again.

In June 2007, the median Single Family Home price on Oahu was $685,000. It went down and did not recover to $685,000 until December 2013, so it took about 6.5 years to fully recover.

Some Realtors say it is Hawaii, and home prices will always increase. That is true if you wait long enough. If you bought at the median price in August 1990, you had to wait until August 2003 for the price to go up, so 13 years.

So what do I recommend?

If you live in your home and don’t have to sell, you don’t need to do anything. Just keep enjoying your home.

If you have to sell now, please don’t worry. You are selling for less but can also buy for less in your new location.

If you are currently renting, you might want to start following the Real Estate market as the prices are dropping and decide when the right time for you is to buy.

If possible, I do not recommend renting long-term. Prices will go up again, and having a home during the up times is a great way to accumulate equity.