Our new listing in Lanikai will save either $71,000 or $145,500 in commission using our $3,500 Flat Fee Selling Option. Learn more at https://www.oahure.com/flat-fee-realtor-hawaii.php

Our new listing in Lanikai will save either $71,000 or $145,500 in commission using our $3,500 Flat Fee Selling Option. Learn more at https://www.oahure.com/flat-fee-realtor-hawaii.php

We do not recommend early occupancy. It opens a can of worms and a lot of problems can come up.

The closing is not guaranteed until all the money is in escrow, and escrow has reported everything to the City and County. This is normally 2 days prior to the actual closing date. So if you are allowing early occupancy 2 days prior to closing you are probably OK. We can check with escrow to verify they can’t pull the recording before you allow the buyers to move in.

However, prior to that, it is very easy for the buyers to decide they don’t want to close, or for the lender to pull the closing because something came up at the last minute such as a job change or job loss. We have seen escrows fall out due to job loss, especially when COVID-19 started and many buyers lost their jobs. We have also seen buyers just change their minds and cancel the escrow.

If anything happens and you do not close, now you have a tenant who hopefully will leave sooner rather than later. They hopefully caused no damage while there, and they hopefully pay you for their time spent in your home. There is a lot of “hoping” things will go right, but plenty of chances things won’t go right and now you have to wait for them to get out until you can relist your property and sell to another buyer.

Other issues could come up once the buyer occupies your property. Maybe the buyer finds the noise level is not acceptable to them, or the commute is longer than they expected. Maybe for some reason, they are just not in love anymore with your property the way they were when they made their offer. That is all it takes for them to cancel the escrow.

In summary, you take all the risks when allowing early occupancy, so it is not something we recommend.

Our recent post of a $775,000 Tear Down that was just listed went viral with over 14,400 Likes, Comments, and Shares.

We received two very strong cash offers on it within 3 days.

I think people could not take that a home in horrible condition would sell for that much. It would have been much better if it was already torn down and just showed a clear vacant lot.

There were three tear-downs that sold within the 2 years for $4.8 million in Kailua, $3.7 million on the North Shore, and $2.1 million in Kahala. This gives you an idea of the value of the land on Oahu.

I do understand people’s frustration with the cost of homes on Oahu. The issue is not because sellers are greedy, or Realtors are pricing it too high, as some comments implied. The real issue is supply and demand along with very low-interest rates.

Oahu, despite the high cost of homes, is still a very nice place to live, and the demand for homes along with our limited land and supply of homes causes the prices to go up.

This seller is saving $60,000 by not paying a buyer’s agent commission, so we can book a showing directly with the seller or buyers can pay their agent a commission as one of the lawsuits against the National Association of Realtors is suggesting.

The vacation rental crackdown in Kailua got rid of most of the competition, so this home we just listed which is a legal B&B is very rare, and the lucky owners will be able to book up easily at a higher rate because of the lack of vacation rentals in Kailua.

The price is $2.4 million. View all the details and more photos.

Just listed for $775,000 in the Kamehameha Heights neighborhood.

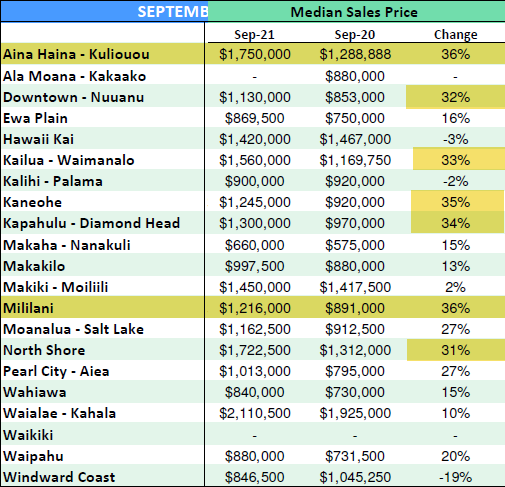

I posted the local market statistics.

Mililani and Aina Haina went up the most at a 36% increase since last year, but 5 other areas also were up over 30%.

As long as your salary has increased around 40% since last year you are staying ahead of inflation on homes. ![]()

![]()

I see a local bank advertising a 6 month CD at 1.2%. That should help us keep up with the 30%+ increase in home prices. ![]()

![]()

![]()

This rate of increase is good for those who are selling and moving to somewhere on the mainland where homes are less expensive.

You can view all the updated local stats at https://www.oahure.com/OahuRealEstateStatsIntro.php.

Sellers ask me all the time is it possible to sell without a buyer’s agent and thereby pay no 2.5% buyer’s agent commission.

The answer is YES.

We have sold 43 homes with no buyer’s agent, which saved those sellers $667,737 in buyer’s agent’s commissions.

I read an article in a Real Estate publication that was titled “6 reasons NAR’s commission rules work”. It was an article that backs up why commissions should stay the same.

There is a lawsuit that contends that buyers should pay their own agent commission. Currently, buyer’s agents are paid a fixed commission from the seller.

The argument is this would allow more competition on the buyer’s agent commission.

For example, on the seller’s commission, there are many options. We offer a $3,500 Flat Fee option, and many sellers pay an agent 2.5% to 3%. However, on the buyer’s side, there are no options. The commission is fixed, normally at 2.5% to 3%. There is no opportunity for a flat fee commission option, or to negotiate the commission based on the amount of work required. If the seller offers anything less than the going commission rate Realtors might not show their home to buyers.

I noticed most Realtors agreed with everything said, but it left me perplexed as I did not agree or understand any of the points made.

The way I see it, Realtors like their fixed 2.5% commission on the buyer’s agent side. They don’t want buyers asking them to reduce the commission, or asking them if they will offer a flat fee. They don’t want a free and open market where buyers have different levels of service and different fees based on the service they get.

I get that. If I am a Realtor representing a buyer purchasing a $2 million property, I am getting $50,000 in commission. Why would I want a buyer asking me if I would do it for a $3,500 Flat Fee instead, or perhaps negotiate the commission down to $5,000 or $10,000?

However, Realtors have to realize from the buyer’s perspective they like the idea of saving $40,000+ on their purchase. If the seller does not have to pay the buyer’s agent $50,000, they can sell for $50,000 less. If the buyer can then pay a $3,500 Flat Fee to their agent, the now saved $50,000 less $3,500 which equals $46,500.

The article tried to convey things like lenders won’t lend on buyer’s agent commissions if paid directly, even though they lend on buyer’s agent commissions now. They said it will be the end of the MLS and would prevent a free and open market, lol. These two are really funny because the MLS makes no money on buyer’s agent commissions, so the MLS will go on regardless, and for them to say a free and open market is forcing sellers to pay 2.5% commission is very strange indeed.

Anyway, it will be very interesting to see if this lawsuit changes anything.

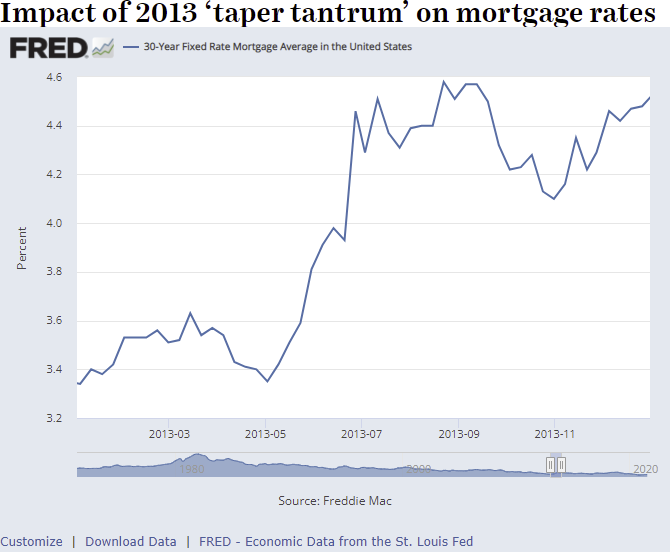

The Fed will start tapering mortgage purchases this year. The chart below shows what happened the last time they did this.

Rates should start going up which will help to cool this overheated seller’s market.

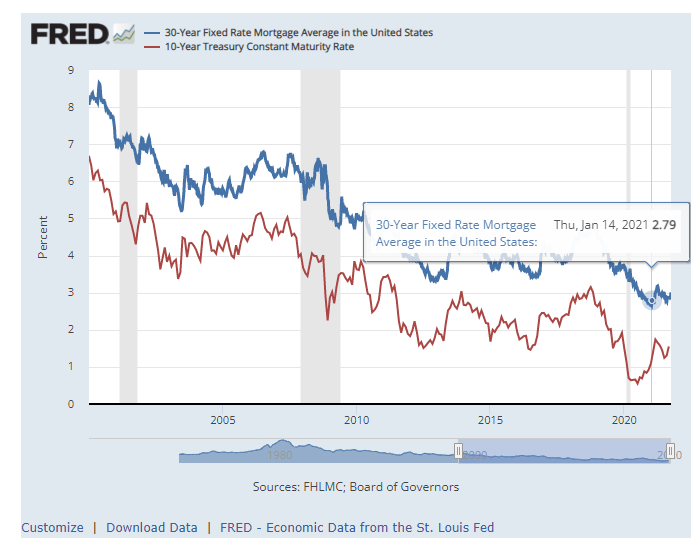

January 2021 mortgage rates hit an all-time low. A more balanced Real Estate market would be nice, but if rates climb too much it could start to drive down prices.

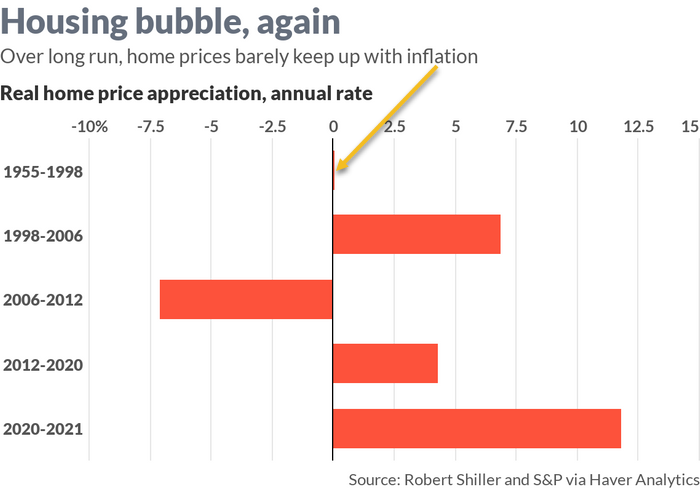

The way I see this chart is 1955-1998 homes prices increased just .1% over inflation.

Then you have a nice increase from 1998 to 2006, but then it is offset by the decline from 2006 to 2012.

Since 2012 it has been rising, and especially this last year.

Over time, home prices can’t grow much faster than household incomes, so it seems at some point it will have to decline again.