WRITTEN BY OSCAR LIBED of Inspect Hawaii

From last month’s article, Are Home Inspectors Deal Makers or Deal Breakers?, we continue the discussion on the “Good Home Inspector”.

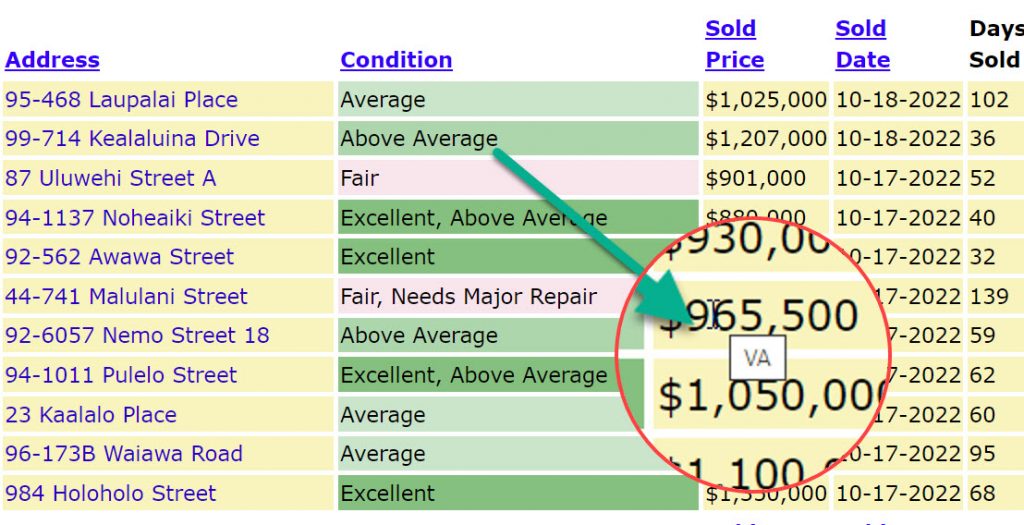

A 2015 survey of 160 Realtors was conducted by a vendor of Home Inspection software services to determine the criteria in selecting a Home Inspector. Here are the results ranked in order of importance:

1) Thoroughness (It is what the Buyer wants. Since the Realtor is representing the interests of the Client, it is incumbent on the Realtor to seek this skill in a Home Inspector.)

2) Certifications and Licensing (There at two national Trade Associations that offer certifications: ASHI (American Society of Home Inspectors) and NACHI (National Association of Certified Home Inspectors). 36 States require Licensing and Regulation of Home Inspectors. Hawaii is not one of them. Realtors are keenly aware that any referral reflects on their reputation, so a Home Inspector with nationwide industry credentials is a safe bet.)

3) Schedule (There is a fixed deadline in the Home Inspection Contingency contained in the Purchase Contract. If the preferred Home Inspector is too busy and cannot meet this deadline, then the Realtor must find another Home Inspector who can.)

4) Quality of Report (For the same house, one Home Inspector can produce 25 pages and another one can produce 75 pages. Some of the “extra” pages are copies of the Standard Practices documents and detailed tutorials on the house defects. Most Realtors prefer a concise and straight-forward documentation of the defects versus reading a novel.)

5) Personal Demeanor (The two key skill sets of a Home Inspector are the “Technical skills” and the “People skills”. If the smartest Home Inspector cannot communicate their findings clearly and objectively to the level of the Client, then it reduces their effectiveness. Both skills are required to be a successful Home Inspector.)

7) Reputation (Realtors are good at “word of mouth” referrals, so Realtors will ask among themselves as to the quality of a Home Inspector. Social media reviews are also a research tool.)

8) Price (The reputation of the Realtor and the quality of the Inspection far exceeds the importance of price. Of course, price cannot be exorbitant, neither should it be “too low” as it implies a lower quality of work. To quote, Benjamin Franklin, “The bitterness of poor quality remains long after the sweetness of low price is forgotten.”)

9) Size of Company (A company with many Inspectors on staff may vary in quality of work and competency. Most Realtors prefer working with an Inspector they know versus an unknown one.)

Are Home Inspectors all the same?

The resounding answer is “No”. Like Realtors, Home Inspectors differ by knowledge, experience, customer service, and unique service benefits.

How does a realtor refer a Home Inspector to a Client?

Some Realtors will suggest 3 or more Home Inspectors for the Client to make the final selection. The Client pays for the Home Inspector, so it is ultimately their decision to choose a Home Inspector. They can even disregard the Realtor’s referrals and find their own Home Inspector. The responsibility is on the Client to make the final decision, not the Realtor.

Some Realtors will not offer any referrals and direct the Client to find their own Home Inspector. In this case, the Client will research the Search Engines on the Internet for Home Inspectors, read social media reviews, and call different Home Inspectors before they make a selection.

Why is it important to select a Good Home Inspector?

From the State Auditor’s Report on the Regulation of Home Inspectors, “Although certification programs are offered to Home Inspectors in Hawaii, we found indications that there are an undetermined number of non-certified individuals who are conducting home inspections in the State.”

What is “Caveat Emptor” regarding Real Estate transactions?

Translation: “Let the Buyer Beware!”

Here is the longer version:

Caveat emptor, quia ignorare non debuit quod jus alienum emit (“Let a purchaser beware, for he ought not to be ignorant of the nature of the property which he is buying from another party.”)

For any questions on this topic, please call Oscar Libed of Inspect Hawaii at 808-728-5707 or send an email to oscar@inspecthawaii.com