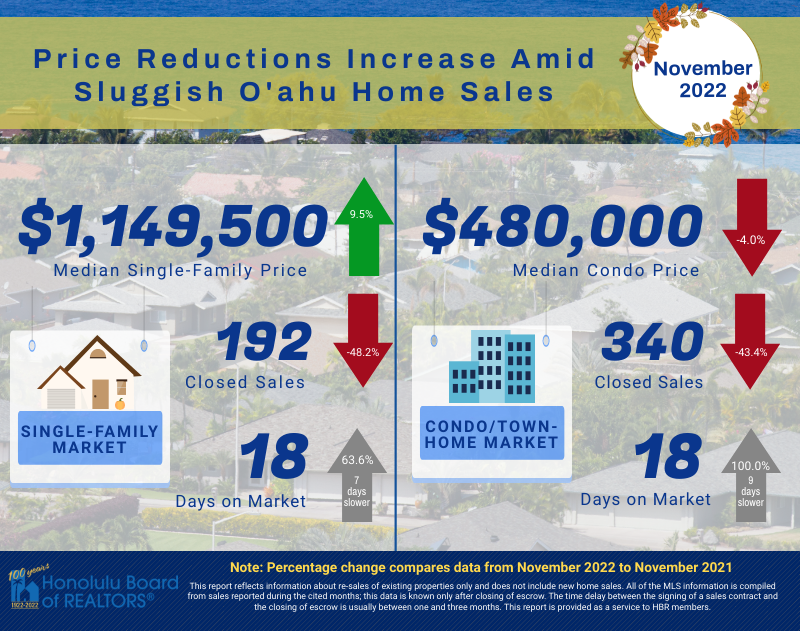

November Single Family Sales Dropped 48.2% From Last Year.

Even larger than during the COVID lockdown.

Much larger than during the 2008 housing crash.

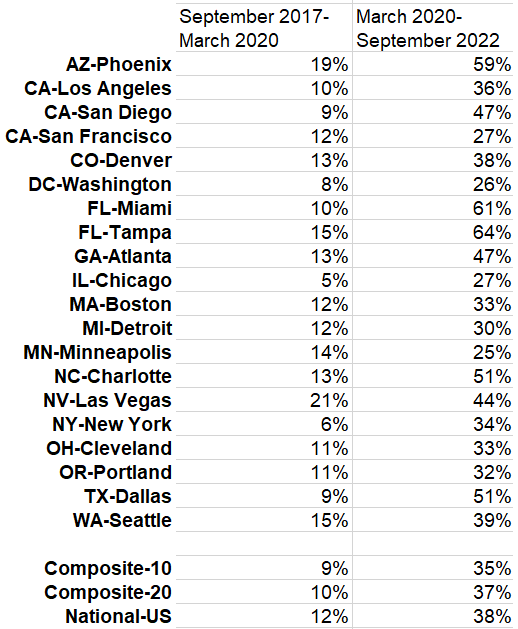

It is amazing the price increase since COVID vs. a more normal price increase in the period before COVID.

Even if prices drop 20%, the price appreciation is still way over normal.

The percentage of sales for first-time buyers is at the lowest level they have ever seen, according to the National Association of Realtors.

High home prices combined with high mortgage rates are making it very difficult for first-time buyers, so it is not surprising they are being held back from making a purchase.

Investors seem to think so based on the 1-year stock declines for the biggest Real Estate public companies.

Approximately 23% of homes in the MLS have an assumable mortgage, but less than 1% of the homes for sale are marked that way.

This means most sellers do not realize their loan is assumable.

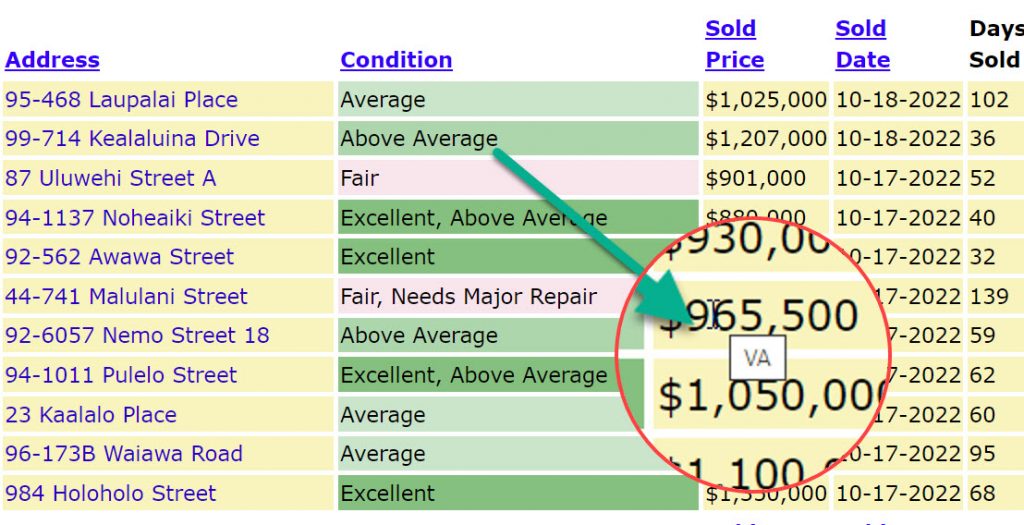

VA, FHA, and USDA loans are assumable by anyone, not just the military.

22% of all sales this year were VA loans, and 1% of sales were FHA or USDA loans.

So approximately 23% of all sales this year and most likely in previous years have an assumable mortgage.

On OahuRE.com, you can see the type of financing used when a home was sold by either mousing over the sold price in the comparison view as shown in the image or viewing the sold price on the property detail page using a mobile phone or desktop.

If you see VA, FHA, or USDA, you then know the loan can be assumed and can discuss that option with the seller, who probably was not aware of it.

As many of those assumable loans would be in the 2% to 4% interest rate range, it is a very attractive option right now to assume that loan.

Mortgage rates could climb another 1.5 percentage points, according to a leading economist.

National Association of Realtors chief economist Lawrence Yun predicted that interest rates could be on their way to 8.5 percent if they pass a threshold of 7 percent, according to Bloomberg. Yun based his forecast on key levels of resistance borrowing costs will face after a key inflation indicator hit a 40-year high.

After creeping toward 6 percent in recent months, the average rate for a 30-year fixed mortgage this week was just over 6.9 percent — a 20-year high — when Yun presented his findings at the National Association of Real Estate Investors in Atlanta.

“Today’s inflation rate report is going to test that 7 percent level,” Yun said in the presentation. “Once it’s broken, the next level of resistance is 8.5 percent, which would be another big shock to the housing market.”

The More Homes on the Market Act, a bipartisan, NAR-endorsed bill recently introduced in the House of Representatives, would double the capital gains exclusion for sales of principal residences from $250,000 to $500,000 for single filers and from $500,000 to $1 million for married couples – and index these amounts for future inflation.

While the bill is unlikely to move in 2022, it’s a great first step to build on next year when a new Congress convenes.