It is frustrating to lose your dream home when there are multiple offers. Here are some tips to help make your offer the one that is accepted.

Summary Check List

- How Many Offers Are There?

- Anything Special the Seller Needs?

- Understand Comparables Sales

- Decide on What Price to Offer

- Add an Appraisal Clause

- Add an Escalation Clause

- Pre-Approval

- Add the As Is Addendum – Learn More

- Cover Letter

- Agree to Not Ask for Repairs nor Credit During the Inspection

- Pay for Survey

- Pay for Termite Inspection

- Remove Cleaning Request

- Shorten Unilateral Extension

- Faster Close

- Rent Back Option

How Many Offers Are There?

First, you need to ask how many offers they have. The more offers, the higher your offer price must be. If just one other offer, you might win by going a little over the asking price, but if there are three or more offers, you will have to go a lot over the asking price to have a good chance of having your offer accepted. To get this number right, you have to know when they will review all offers. Perhaps when you make your offer, there is only one other offer, but they are waiting four days to review offers, and by that time, it looks like there will be ten offers, so you have to adjust your price accordingly and submit a new offer. Note that the more offers they have, the higher over the asking price you have to go.

Anything Special the Seller Needs?

You also want to know if there is anything special the seller needs in their offer. Perhaps a fast close, or rent back, or a long close, etc. If you can put those things in upfront, it makes your offer more attractive.

Understand Comparables Sales

You must understand the comparable sales because there is a chance the home was priced under the comparables, which is why there is so much interest. Comparable sales are critical to both buyers and sellers, which is why on OahuRE.com’s website, we emphasize making it easy to see similar sales, including not just sold listings but withdrawn and expired listings too.

Add an Appraisal Clause

If you know homes in that area are selling for $1,050,000 and the seller is asking under $1,000,000, there is a good chance the winning offer will be around $1,050,000 or higher. If you know the comparables well, you can determine the home’s value and offer accordingly.

When sellers get multiple offers over what they felt was their market value, they will be concerned about the appraisal. What happens if the appraisal comes in close to the asking price even if the offer is a lot higher? An appraisal clause is essential in a multiple offer situation. This clause states how much over the appraised value you are willing to pay. Depending on your down payment, you might need to put more money down if the appraisal is low.

For example, you might say you are willing to continue with the purchase as long as the appraisal is no less than $20,000 under your offer price. This means if you offer $800,000 and the appraisal comes in at $780,000, you won’t ask the seller for a price reduction, and you do not have the right to cancel. You can write it up where you will pay up to $20,000 over the appraised price up to your offer price. This way, if the appraisal comes in at $770,000, the seller knows you will buy the home for $790,000. You can see why the appraisal clause is attractive to sellers.

We are also seeing appraisal clauses with no limits. For example, the clause just states the buyer will continue with the purchase regardless of the appraised price.

I have seen many sellers go with the offer with the highest appraisal clause, and they counter that offer to match the highest offer they received that did not have the best appraisal clause.

Add an Escalation Clause

The way the escalation clause works is you state you will pay up to $X over the highest competing offer, and the seller will have to present that offer to you as proof of the higher offer.

Normally I don’t recommend an escalation clause because most of the time they do not work. However, I see many Realtors using it, but as we sell a lot of properties representing sellers and I see it failing most of the time.

There are times when it can be helpful. For example, with a high-priced property, if you are going to escalate $50,000 or $100,000 over the highest offer, that will catch the seller’s attention and could work. This assumes you already have an appraisal clause in place, and a large down payment so they understand you can easily afford to pay $50,000 to $100,000 more and it will not push you out of your comfort zone.

What I have noticed is normally, the seller will go with the highest offer. The reason for this is they have a feeling by pushing a lower offer higher, they are pushing the buyer out of their comfort zone, so they are more likely to ask for credit or cancel during the inspection. The higher offer is already comfortable enough to make that offer, so they do not have to push them outside their comfort zone; therefore, they are less likely to ask for credit or cancel during the inspection.

However, if your offer is close to the highest offer, it has the best appraisal clause and has the escalation clause, then there is a good chance the seller will activate the escalation clause and accept your offer because they like your appraisal clause.

Buyers should not think they can offer a lower price because the escalation clause is in place. That is a strategy that will not get your offer accepted.

Pre-Approval

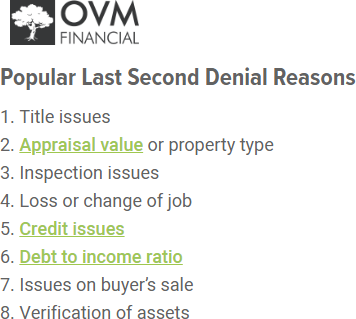

A pre-approval is a must-have item for any offer, and without one, the seller will not even consider your offer. It is nice if it states your credit, income, and cash were verified so the seller has confidence your loan will close. Also, Realtors and sellers prefer working with local banks vs. mainland banks, which could be important.

Cover Letter

You could include a cover letter, perhaps with a picture of your family, but this is not a huge factor in the seller choosing your offer. These letters are not recommended by the National Association of Realtors because of potential discrimination issues, so some seller’s agents might not accept them, but you can always submit one and leave it up to the seller’s agent if they will present it.

With our $3,500 Flat Fee Selling Option, sometimes the sellers prefer to do the showings themselves rather than use a lockbox, and in that case, they meet all the potential buyers. They tell me they have good feelings about certain buyers, so if you get a chance to meet the seller, keep that in mind. The last thing you want to do is give any negative feedback or energy about the house. Nothing turns sellers off faster than a complaint about their home.

Additional Things to Do

There are other smaller things you can do such as; add the As Is Addendum, agree not to ask for repairs or credit during the home inspection (you still have the right to cancel), pay for the survey, pay for the termite inspection, remove the cleaning request, shorten the unilateral extension period, offer a faster close, and offer a free rent back to the seller if they need a couple of extra days to get out of the home after closing, and put in a seller credit they can use for their closing costs. However, these things are icing on the cake. The appraisal clause and the price you offer will be the two biggest factors in their decision.